In the high-stakes arena of global finance, few tales are as astonishing as the Deutsche Bank mirror trading scandal. Between 2011 and 2014, a crafty money laundering operation quietly siphoned $10 billion out of Russia, right under the noses of one of the world’s banking giants. Thousands of stock trades, mirrored so perfectly that they seemed innocent, were secretly funneling money across borders — a true wolf in sheep’s clothing. Fast forward to 2025, and the ripple effects are still felt, pushing banks to tighten their guards and reminding us all of the constant need for watchfulness in our intricate financial web.

Setting the Stage for the scandal

Imagine wanting to move your money from one country to another but facing a wall of strict rules and restrictions. This was exactly the problem facing wealthy Russians in 2011. At the time, Russia had tight controls on moving money out of the country – a way to keep Russian wealth inside Russian borders.

These wealthy individuals were looking for a way to protect their money by moving it to Western banks, away from Russia’s uncertain economic and political climate. Some might have wanted to dodge taxes, while others were simply nervous about keeping all their wealth in Russia. The traditional ways of moving money abroad were either blocked or closely watched by Russian authorities.

That’s when someone discovered the perfect loophole – mirror trading. On paper, it looked like routine stock trading. In reality, it was a financial sleight of hand that would move billions right under the watchdogs’ noses.

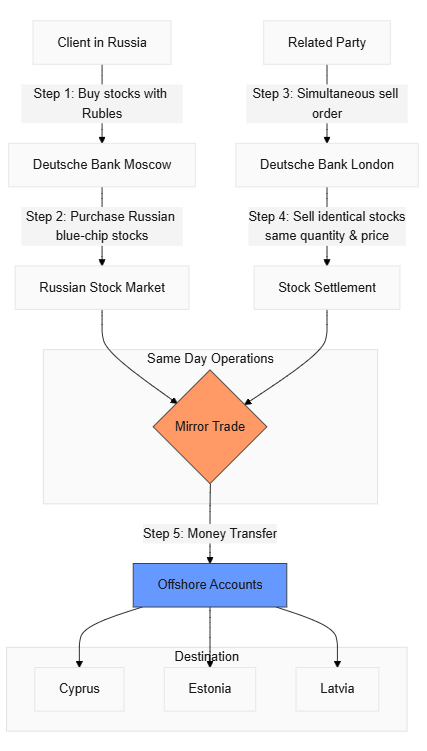

Illustration 1

So, what is mirror trading?

Here’s how it works in simple terms:

- You buy some stocks in one country using your local money.

- At the same time, your buddy in another country sells the exact same stocks for their local money.

- Voila! You’ve moved money from one country to another without actually sending it directly.

It’s like passing a secret note in class, but instead of a note, it’s money, and instead of passing it across the room, you’re moving it across countries.

How Mirror Trading Became a $10 Billion Money Tunnel

In normal circumstances, mirror trading is a way for regular folks to copy the moves of expert traders. But in this scandal, some clever (and not so honest) people saw an opportunity. They used this back-and-forth game to move a staggering $10 billion out of Russia without raising eyebrows. Here’s how they pulled it off:

- A client of Deutsche Bank’s Moscow branch would buy Russian blue-chip stocks using rubles.

- Almost immediately, often on the very same day, a related party would sell the identical stocks, in the same quantity and at the same price, through Deutsche Bank’s London branch.

- Voila! Rubles turned into dollars, and money moved from Russia to accounts in places like Cyprus, Estonia, and Latvia.

This sneaky money dance happened over 2,400 times in just a few years – that’s a lot of financial footwork! Like a magician’s secret trap door hidden behind a curtain, these trades created an invisible highway for billions to zoom across borders while looking like just another day at the stock market.

Illustration 2: Flowchart of Mirror Trade

How Deutsche Bank’s Mirror Trading Scandal Was Uncovered

On a quiet August morning in 2014, a Deutsche Bank employee’s routine check turned into anything but routine. Their computer screen showed patterns that didn’t add up – the first thread that would unravel one of banking industry’s biggest scandals.

The truth exploded in February 2015 like a bomb in the boardroom. Bank executives sat stunned as they realized billions of dollars had been flowing right under their noses for years. What started as a suspicious blip on a screen had morphed into a full-blown financial nightmare, sending the bank’s top brass scrambling for answers.

The numbers told a jaw-dropping story: from April 2012 to October 2014, more than 2,400 pairs of perfectly matched trades had waltzed through the bank’s offices in Moscow and London. Like a master magician’s trick, these trades made money vanish from Russia and reappear in the West, while another $3.8 billion slipped through in suspicious one-side deals. By the time anyone spotted the scheme, $10 billion had already disappeared through this financial trapdoor.

The Fallout: Consequences for Deutsche Bank and Its Employees

When the scheme finally came to light, it wasn’t pretty:

- Deutsche Bank got slapped with fines totaling nearly $600 million.

- Two Co-CEOs quit after Deutsche Bank’s $10 billion Russian money laundering scandal. Other executives and senior leadership roles were also fired as an aftermath of the scandal.

- In 2019, Deutsche Bank cut 19,000 jobs (20% of staff) as part of a major clean-up effort.

- The remaining staff faced strict oversight and tougher compliance rules.

The Hidden Cost: How This Banking Scandal Reaches Your Wallet

You might think a $10 billion banking scandal only matters to the super-rich, but here’s the dark truth – we’re all paying for this massive financial deception:

- The first wave hits our wallets quietly but surely. Banks don’t simply absorb massive fines – they pass these costs down through increased fees and service charges. Each new fee on your statement carries a small piece of this scandal’s price tag.

- Next comes the bureaucratic burden. In the aftermath of such schemes, banks have transformed their approach to customer service. That simple task of opening a bank account? It’s now a complex process of verification and documentation, as financial institutions scramble to prevent the next scandal.

- The broader economic impact runs even deeper. When billions of dollars move illicitly through the financial system, it weakens the very foundation of our economy. Employment becomes less stable, market confidence wavers, and economic growth slows – effects that touch every corner of society.

The sobering reality is that financial misconduct at this scale creates a lasting legacy. While the headlines may fade, we continue to bear the cost of restored trust through stricter regulations, higher fees, and a fundamentally changed banking relationship.

Beyond the Scandal: What We Learned

The Deutsche Bank mirror trading scandal showed us just how weak global banking systems can be. Billions of dollars slipped through unnoticed, starting with what seemed like regular trades but turning into a huge money-laundering operation that moved about $10 billion out of Russia from 2011 to 2014. This story reminds us that banks need to stay alert, have strong checks in place, and be open about their practices to stop such schemes from happening again.