Introduction to the Case

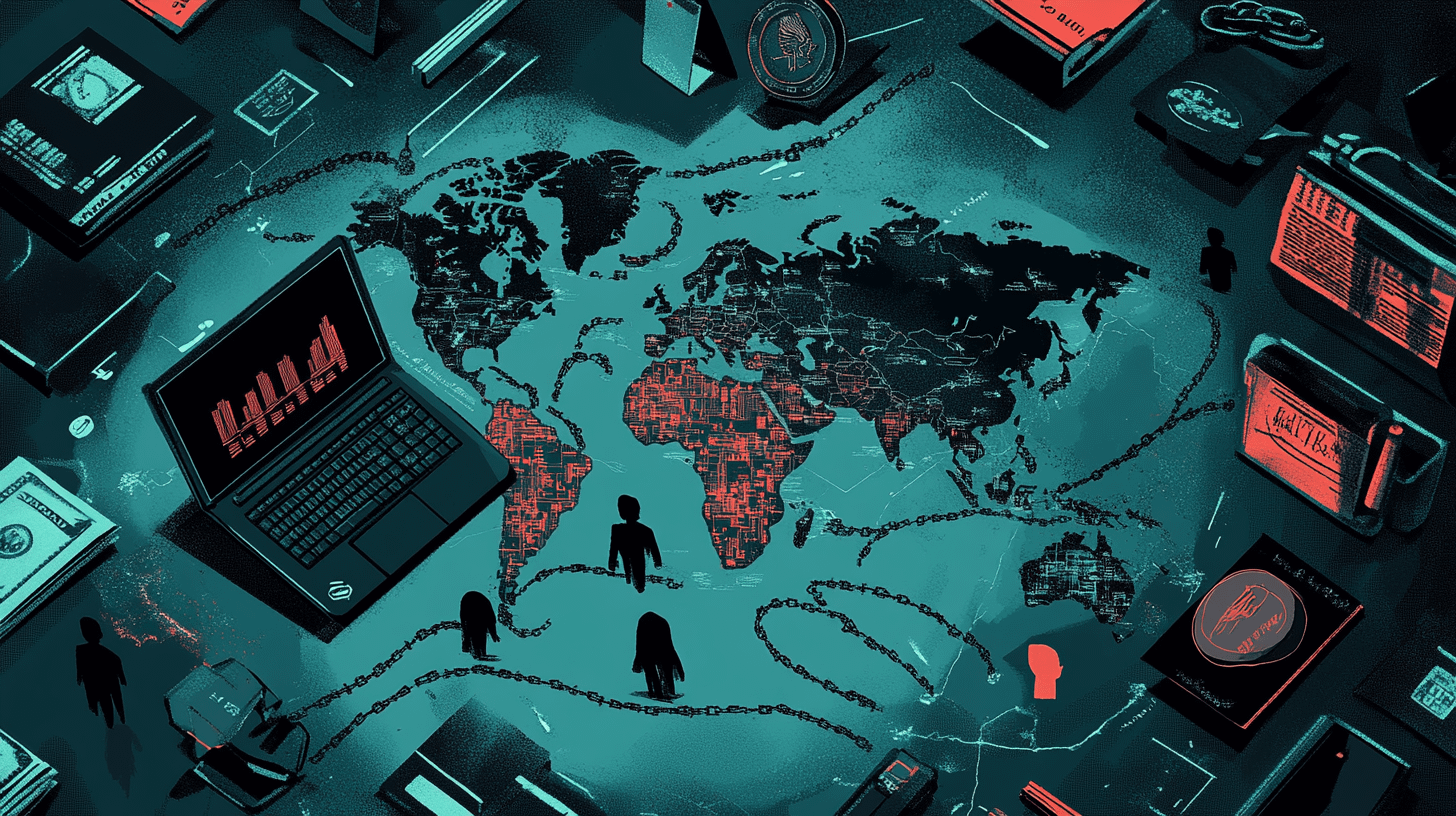

In 2017, authorities uncovered a major international sex trafficking and money laundering operation in Minneapolis. This criminal enterprise trafficked hundreds of Thai women across the United States, including cities like Los Angeles, Chicago, and Houston. The investigation led to the indictment of 21 individuals, exposing a network that exploited vulnerable women and funneled millions of dollars through a sophisticated financial scheme.

The victims were promised better opportunities in the U.S., but upon arrival, they were forced into prostitution to repay massive “bondage debts” ranging from $40,000 to $60,000. While the trafficking itself was horrifying, the money laundering tactics used to fund and sustain this operation were equally alarming.

The Trafficking Operation

The traffickers operated with precision. They isolated the victims from the outside world, restricted their movements, and forced them to work long hours in brothels across multiple cities. To keep them compliant, the organization threatened harm to their families back in Thailand. But this wasn’t just about trafficking people—it was about making and hiding enormous profits. That’s where their money laundering tactics came into play.

Money Laundering Tactics: How They Hid Their Profits

Money laundering was at the heart of this criminal enterprise. The traffickers used a variety of methods to disguise their illegal earnings and keep their operation running smoothly without drawing attention from law enforcement or financial institutions.

Funnel Accounts

One of their primary methods was using funnel accounts. These accounts were opened under victims’ names at banks across the U.S. Criminals deposited cash into these accounts in one city and withdrew it in another—often Los Angeles—without raising suspicion. By keeping transaction amounts below reporting thresholds required by anti-money laundering (AML) laws, they avoided detection.

Hawala System

The organization also relied on the hawala system, an informal money transfer network based on trust. This system allowed them to move large sums internationally without using traditional banking channels or leaving a paper trail. Funds were transferred between intermediaries until they reached Thailand or other destinations.

Cash Smuggling

Bulk cash smuggling was another tactic. Money mules carried large amounts of cash—sometimes hidden in clothing or dolls—on trips to Thailand. This method allowed criminals to bypass banking systems entirely while physically moving their profits overseas.

Trade-Based Money Laundering

The group also engaged in trade-based money laundering. They purchased goods using illicit funds and exported them for sale in foreign countries. By manipulating invoices or undervaluing goods, they disguised illegal profits as legitimate business transactions.

Structuring Transactions

To avoid triggering suspicion from banks, traffickers structured transactions by breaking large sums into smaller deposits or withdrawals. These smaller amounts flew under the radar of financial institutions’ reporting systems.

Cryptocurrency

While not heavily emphasized in this case, cryptocurrency is increasingly being used by criminal organizations for its anonymity and lack of consistent regulation worldwide. It’s likely that similar operations may adopt this tactic as technology evolves.

The Investigation and Takedown

The takedown of this operation required extensive coordination between law enforcement agencies and financial institutions. Investigators pieced together evidence from bank records, travel documents, and victim testimonies to unravel the network’s complex financial web.

By the end of the investigation:

- 20 arrests were made.

- Victims were rescued from active houses of prostitution.

- Hundreds of thousands of dollars in cash were seized.

- Numerous weapons were confiscated.

The indictment charged those involved with offenses including sex trafficking, fraud, human trafficking, threats of force, and money laundering.

Why Money Laundering Fuels Criminal Enterprises?

This case highlights how critical money laundering is to sustaining criminal operations like human trafficking. Without ways to clean their illegal profits, these enterprises wouldn’t be able to function at such a large scale. Money laundering allows criminals to integrate dirty money into legitimate financial systems, making it harder for authorities to trace its origins.

By exploiting loopholes in banking regulations and using sophisticated methods like funnel accounts and trade-based laundering, traffickers can fund their operations while avoiding detection. These tactics don’t just hide profits—they enable criminals to expand their networks, recruit more victims, and perpetuate cycles of exploitation.

Conclusion

Money laundering isn’t just about hiding profits—it’s what allows criminal enterprises like human trafficking rings to exist in the first place. By disguising illegal earnings as legitimate income, traffickers can fund their operations undetected while continuing to exploit vulnerable people.

This case serves as a stark reminder that tackling human trafficking requires addressing its financial backbone: money laundering. Without these sophisticated schemes, such operations would struggle to survive. It’s up to governments, law enforcement agencies, financial institutions, and communities to work together to disrupt these networks and ensure that justice prevails—for both victims and society as a whole.