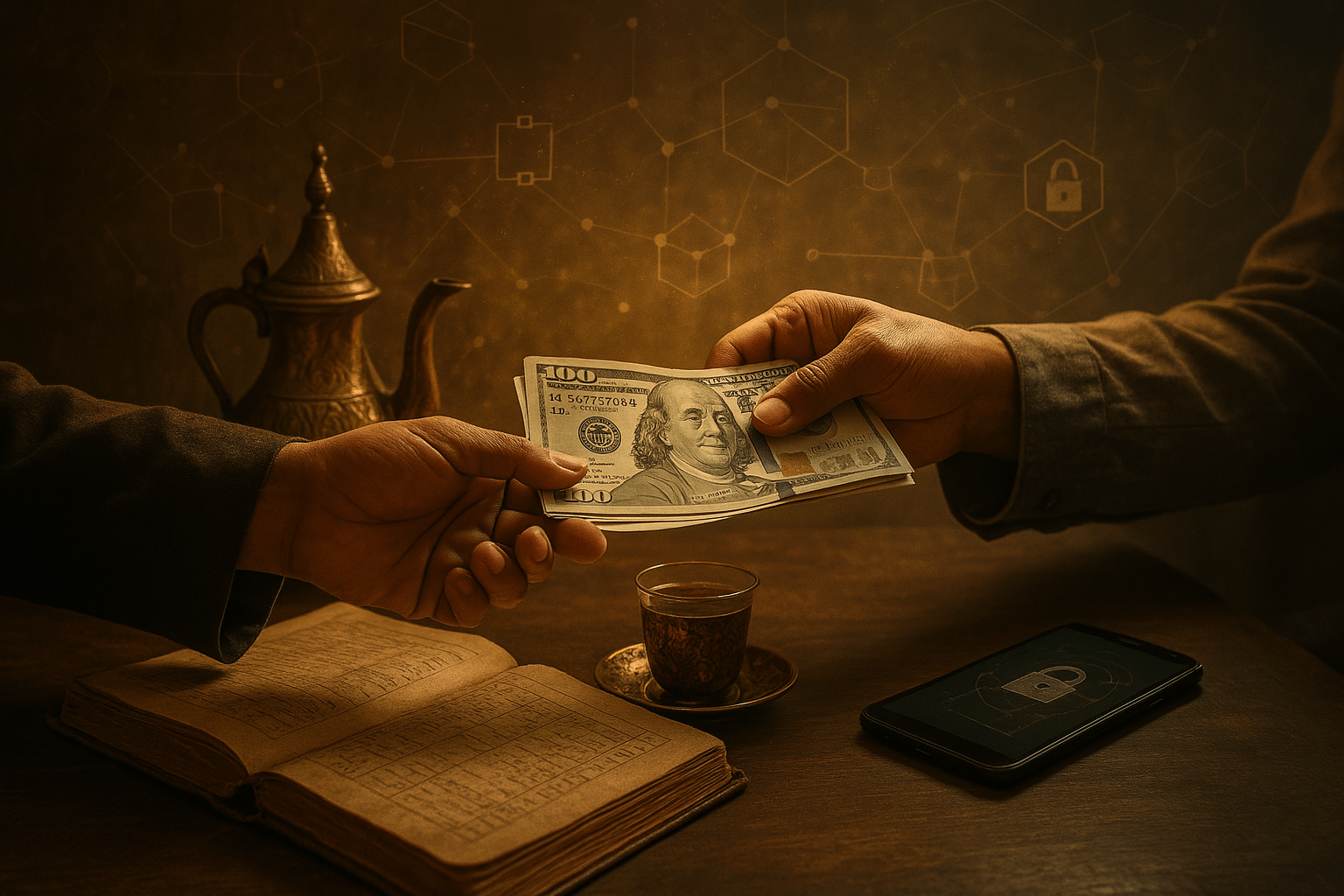

In a world where technology drives almost every financial transaction, there exists a parallel system that thrives on trust and personal networks. This system, known as Hawala, is an ancient method of transferring money that operates outside the formal banking system. Its simplicity and efficiency have made it indispensable for many, but its lack of regulation has also attracted scrutiny. Let’s dive into the fascinating world of Hawala and other informal value transfer systems (IVTSs), exploring how they work, their benefits, and the risks they pose.

What Exactly Are Informal Value Transfer Systems?

Informal Value Transfer Systems (IVTSs) are alternative remittance systems that bypass traditional banking channels. They’ve been around for centuries and are especially common in regions like Africa, Asia, and the Middle East. What makes these systems unique is their reliance on trust rather than formal contracts or legal frameworks.

Different cultures have their own names for IVTSs:

- Hawala (Arabic): Meaning “change” or “transform.”

- Hundi (Hindi): Translating to “collect.”

- Chiti banking (China) and Poey kuan (Thailand) are other examples.

Despite their differences, these systems share a common thread: they enable quick, cost-effective money transfers without moving physical cash or leaving a paper trail.

How Does Hawala Work?

The mechanics of Hawala are surprisingly straightforward yet ingenious. This system originated centuries ago in India and China as a way to securely transfer funds over long distances without physically moving the money.

Here’s how it works:

- A sender approaches a hawaladar (broker) in one country and gives them the amount to be transferred.

- The hawaladar contacts another broker in the recipient’s location.

- The receiving broker disburses the equivalent amount to the recipient—no cash crosses borders.

- Later, the two brokers settle their accounts informally, often through trade or other arrangements.

This process is fast, inexpensive, and completely reliant on trust between brokers. In modern times, hawaladars often use coded messages via couriers, emails, or even encrypted online platforms to communicate transactions.

For migrant workers sending money home or individuals in regions with limited access to formal banking, Hawala is a lifeline. It’s faster than traditional bank transfers and avoids hefty fees. However, its lack of documentation raises serious concerns.

The Dark Side: Money Laundering and Terrorist Financing

While most Hawala transactions are legitimate—helping families stay connected financially—its anonymity and lack of oversight make it a magnet for illicit activities. Regulatory bodies like the Financial Action Task Force (FATF) have flagged IVTSs as high-risk for money laundering and terrorist financing.

Here’s why:

- No Paper Trail: Transactions leave little evidence, making it nearly impossible to trace funds.

- Minimal Oversight: Many hawaladars operate without licenses or government supervision.

- Encrypted Platforms: Some brokers now use encrypted communication tools to further obscure transactions.

Authorities have documented cases where Hawala was used at every stage of money laundering:

- Placement: Criminals deposit illicit cash with a hawaladar under the guise of business income.

- Layering: Funds are moved through multiple brokers across countries to obscure their origin.

- Integration: The cleaned money re-enters the economy as legitimate business revenue or investments.

Why Do People Still Use Hawala?

Despite its risks, Hawala remains incredibly popular—and for good reason:

- Accessibility: In many remote or conflict-ridden areas, formal banking simply doesn’t exist.

- Affordability: Fees are often lower than those charged by banks or international wire services.

- Speed: Transactions can be completed within hours.

- Cultural Trust: Many users feel more comfortable dealing with someone from their own community or ethnic group.

For many migrant workers in countries like the UAE or Australia, where access to regulated financial services may be limited due to immigration status or other barriers, Hawala offers an invaluable service.

The Balancing Act: Regulation vs Tradition

Regulating Hawala is tricky. On one hand, tighter controls could curb its misuse for illegal activities like drug trafficking or terrorism financing. On the other hand, over-regulation might push legitimate users further into unregulated spaces.

Some experts suggest a middle ground: bringing hawaladars into the regulatory fold without dismantling their networks entirely. For instance:

- Governments could require hawaladars to register their businesses.

- Basic recordkeeping could be mandated without compromising user privacy.

- Education campaigns could inform users about safer alternatives when available.

Key Takeaways

Hawala is more than just an informal money transfer system—it’s a cultural institution rooted in trust and necessity. While it offers undeniable benefits for millions worldwide, its vulnerabilities cannot be ignored:

- It enables fast and affordable remittances but lacks transparency.

- Its unregulated nature makes it attractive for illicit activities like money laundering and terrorist financing.

- Striking a balance between preserving its benefits and mitigating its risks is essential for policymakers.

As we navigate this complex issue, one thing is clear: understanding systems like Hawala isn’t just about cracking down on crime—it’s about addressing the economic realities that make such systems indispensable in the first place.

Stay tuned for our next blog post, where we’ll explore real-world examples of how Hawala has been misused—including high-profile cases that have shaped global policies around informal value transfer systems!